gentleherd.ru

News

Paying Twice A Month On Credit Cards

Keep in mind that if you carry over a balance from the previous month, any payment you make before your statement's due date is applied to that prior balance. What the Credit Card Issuer Must Do · Credit your account the day they get your payment. · Inform you in your monthly billing statement for each billing period. When you make multiple payments in a month, you reduce the amount of credit you're using compared with your credit limits — a favorable factor. When a customer's credit card payment gets processed twice, the merchant can void the extra charge before the settlement cut off time of 3 PM PST. May I make my payment with a credit card? No. Your monthly payment must be drafted from a checking or savings account, or mailed to us. Will you accept less. You cannot split a payment between two or more credit cards. Split 15th and end of month — charged twice a month on the 15th and last day of the month. Instead of a monthly amount, pay half every other week with biweekly payments. It's the easy way to add an extra payment to your debt payoff plan. Here's an idea — try splitting your monthly payment in half and pay it every two weeks. Most months there will be no difference, but keeping to this schedule. The lesson here is that every little bit counts. Paying twice your minimum or more can drastically cut down the time it takes to pay off the balance, which. Keep in mind that if you carry over a balance from the previous month, any payment you make before your statement's due date is applied to that prior balance. What the Credit Card Issuer Must Do · Credit your account the day they get your payment. · Inform you in your monthly billing statement for each billing period. When you make multiple payments in a month, you reduce the amount of credit you're using compared with your credit limits — a favorable factor. When a customer's credit card payment gets processed twice, the merchant can void the extra charge before the settlement cut off time of 3 PM PST. May I make my payment with a credit card? No. Your monthly payment must be drafted from a checking or savings account, or mailed to us. Will you accept less. You cannot split a payment between two or more credit cards. Split 15th and end of month — charged twice a month on the 15th and last day of the month. Instead of a monthly amount, pay half every other week with biweekly payments. It's the easy way to add an extra payment to your debt payoff plan. Here's an idea — try splitting your monthly payment in half and pay it every two weeks. Most months there will be no difference, but keeping to this schedule. The lesson here is that every little bit counts. Paying twice your minimum or more can drastically cut down the time it takes to pay off the balance, which.

If you take that option, however, your credit card company may close your account and increase your monthly payment, subject to certain limitations. For example. To avoid backdating, you should pay your balance in full every month or find another credit card company which does not backdate interest. Retroactive Hikes in. On that same note, making payments more than once a month may lower your interest payments and your credit utilization rate. If you're having difficulty making. Higher interest rates aren't just a future problem. The credit card company is likely to raise the interest rate on your account. It can do that after two. Paying your balance more than once per month makes it more likely that you'll have a lower credit utilization rate when the bureaus receive your information. While some credit cards charge interest on interest, Flex Pay and Uplift charge only simple interest. If you carry a balance on a credit card, it can be hard to. Don't make late payments. Doing so will damage your credit score and will also incur late payment charges on your account.3 Your credit cards will likely have a. You may need your lender's permission before you can begin making payments twice a month instead of once. You should consult your lender on payment options, and. It uses your existing credit line and there's no application, credit check or origination fee – just fixed monthly payments with no interest during your chosen. Turn eligible credit card purchases into equal monthly payments over 6, 12 or 18 months - for a fee and 0% Annual Interest Rate. How bi-weekly payments work · With a monthly payment schedule, you make 12 payments in a year. · When you go to a bi-weekly payment schedule, the payment amount. Change due dates—Many credit card issuers allow a person to change the monthly payment due date. · Set up automatic payments—Taking advantage of automatic. Yes, you should pay more than the minimum on your credit card. While paying the minimum amount due on time every month will keep your account current, paying. The 15/3 credit card payment hack is a credit optimization strategy that involves making two credit card payments per month. Please note: You may change your payment due date once every 12 months, but the 3, 6, 10, 15, 19, 24, 26, 29, 30, and 31 of any month aren't available to select. Make the minimum payment on all your cards to avoid late fees and finance charges. · Pay extra on your credit card with the highest interest rate. · Once that. However, in general, you shouldn't panic if you make a payment and your credit scores don't immediately change. At the end of the billing cycle, when many. If the balance is not paid off within the promotional period or if the patient misses a monthly payment, however, interest rates can quickly jump to as much as. - Make your payments more manageable. If you prefer you can simply make “half payments” twice a month, on the days you pick, so long as your entire payment. Under the bi-weekly plan, you will make payments to your lender every two weeks instead of monthly of half of your monthly payment.

What Are Some Ways To Invest

The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer. Among the strategies to consider are: Annuities, which can generate a guaranteed stream of income for a period of years or until your death or the death of you. Zero commission fees for stock, ETF, options trades and some mutual funds invest in several index funds and ETFs based on your goals and risk tolerance. Discover all the ways to invest with J.P. Morgan, from self-directed investing to expert advice from our J.P. Morgan advisors. Learn more here. Before you purchase investments, be sure to build an emergency savings fund to cover your needs for at least three months. Keep the savings in an insured bank. 12 Great Ways to Invest in Yourself · Embrace lifelong learning · Prioritize your mental health · Set goals · Find a mentor · Start a journal · Practice gratitude. Key Takeaways · Regularly set aside a certain amount to save. · Look into savings apps that round up your purchases and save the small change. · Pay off high-. Real Estate Investment Trusts (REITs): REITs invest in income-generating real estate properties. They distribute a significant portion of their. Investing. Investing is one of the ways in which money can begin to work for you and offer an additional stream of income. Students are often times curious. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer. Among the strategies to consider are: Annuities, which can generate a guaranteed stream of income for a period of years or until your death or the death of you. Zero commission fees for stock, ETF, options trades and some mutual funds invest in several index funds and ETFs based on your goals and risk tolerance. Discover all the ways to invest with J.P. Morgan, from self-directed investing to expert advice from our J.P. Morgan advisors. Learn more here. Before you purchase investments, be sure to build an emergency savings fund to cover your needs for at least three months. Keep the savings in an insured bank. 12 Great Ways to Invest in Yourself · Embrace lifelong learning · Prioritize your mental health · Set goals · Find a mentor · Start a journal · Practice gratitude. Key Takeaways · Regularly set aside a certain amount to save. · Look into savings apps that round up your purchases and save the small change. · Pay off high-. Real Estate Investment Trusts (REITs): REITs invest in income-generating real estate properties. They distribute a significant portion of their. Investing. Investing is one of the ways in which money can begin to work for you and offer an additional stream of income. Students are often times curious.

Growth investments · Property. Includes investing in residential and commercial property. · Shares. Investing in a company. · Alternative investments. Includes. If you are looking for a very easy, reasonably safe way to invest your money I would recommend you to open a Stock Account with your bank and. Each section provides an introduction to the investment, explains the types of investments you may come across and lays out important risks. Along the way. Investing in stocksOpens DialogFootnote 1, for example, has the potential to provide higher returns. In contrast, investing in a money market or a savings. How to invest money. Identify your investing style. Determine your budget for investing. Assess your risk tolerance. Decide what to invest your money in. Certain authorized federal agencies may invest funds with Treasury. The software used to transact investments is called FedInvest. Federal Investments Program. Where to Invest Money? · Insurance plans · Mutual funds · Fixed deposits, Public Provident Fund (PPF) and small savings accounts · Real estate · Stock market. Invest it in a widely spread ETF like the S&P and the MSCI World. Which have been going up in the long run. Repeat and let the power of. Step 4: Your Investment options · Shares · Funds · Exchange Traded Funds (ETFs) · Investment Trusts · Bonds and Gilts. That's right — this could be the year when you prioritize your financial future. Contributing more today to your retirement and/or brokerage accounts could. The SEC recommends that you ask questions and check out the answers with an unbiased source before you invest. Always take your time and talk to trusted friends. Investing can help you pursue your most important financial goals, but what should you invest in? The building blocks include stocks, bonds. Stocks, bonds, mutual funds and ETFs are the most common asset categories. These are among the asset categories you would likely choose from when investing in a. Start with safer investments, such as bonds, mutual funds, and retirement accounts, while you're still learning the market. The organization must pay investors a pre-determined interest rate on a set payment period. Or, sometimes, at maturity. With these types of investments, you. Don't just let the money stay on saving bank account. The money should work. Starting small investing in investment account whenever possible. Research such. investments. The way you divide your money among these. Managed Account Advisors LLC (MAA), Merrill's affiliate, is the overlay portfolio manager responsible for implementing the Merrill Guided Investing strategies. Many people get into the habit of saving or investing by following this advice: pay yourself first. Students can do this by dividing their allowance and. Stocks, bonds, mutual funds and ETFs are the most common asset categories. These are among the asset categories you would likely choose from when investing in a.

Single Garage Door Installation Cost

A steel 8' x 7' garage door (standard single door) averages $1, installed. A steel 16' x 7' garage door (standard double door) averages around $2, So, what might be the cost of a Garage Door Installation in San Jose, CA? Costs can vary significantly, but to give you a ballpark figure, most homeowners spend. A single car, hollow steel door with no windows was quoted at $1, (parts & labor). An average-sized sectional door typically costs between $ and $2, with installation, depending on the material. All of the doors can be installed to. Replacing the entire door, frame and hinges with a new opener could run between $1k max, depending upon the size of the garage, the size of. Garage Door Opener Costs ; 1. Door opener: HP belt drive; 2 remotes; wall switch; 2 lamps (bulbs not included), $, each ; 2. Circuit upgrade: 25' of. Low end around $, up to for models with all the bells and whistles, wifi, battery backup, security camera, extra remote, wireless. Homeowners can expect to pay about $ to $1, for a standard, single garage door and $ to $1, for a double car door. Having said that, the total cost. In April the cost to Install a Garage Door starts at $ - $1, per door. Use our Cost Calculator for cost estimate examples customized to the location. A steel 8' x 7' garage door (standard single door) averages $1, installed. A steel 16' x 7' garage door (standard double door) averages around $2, So, what might be the cost of a Garage Door Installation in San Jose, CA? Costs can vary significantly, but to give you a ballpark figure, most homeowners spend. A single car, hollow steel door with no windows was quoted at $1, (parts & labor). An average-sized sectional door typically costs between $ and $2, with installation, depending on the material. All of the doors can be installed to. Replacing the entire door, frame and hinges with a new opener could run between $1k max, depending upon the size of the garage, the size of. Garage Door Opener Costs ; 1. Door opener: HP belt drive; 2 remotes; wall switch; 2 lamps (bulbs not included), $, each ; 2. Circuit upgrade: 25' of. Low end around $, up to for models with all the bells and whistles, wifi, battery backup, security camera, extra remote, wireless. Homeowners can expect to pay about $ to $1, for a standard, single garage door and $ to $1, for a double car door. Having said that, the total cost. In April the cost to Install a Garage Door starts at $ - $1, per door. Use our Cost Calculator for cost estimate examples customized to the location.

One garage door and opener: $2,; Labor and installation: $ View our Garage Door Installation Cost Guide to learn more about project costs and two or. The average price tag runs $1,, according to gentleherd.ru Most garage owners pay between $ and $1,, but the total price tag could run many thousands. Average Costs · 1 door: $1, · 2 doors: $3, · 3 doors: $5, The basic cost to Install a Single Garage Door is $ - $ per door in April , but can vary significantly with site conditions and options. Replacing the entire door, frame and hinges with a new opener could run between $1k max, depending upon the size of the garage, the size of. A single car, hollow steel door with no windows was quoted at $1, (parts & labor). The standard size for a single garage door is 8 x 7 feet, although there are other variations available. Insulated doors and doors with windows will come at a. However, for most homeowners, a new replacement garage door typically falls within the price range of $1, to $2, Now, a critical piece of advice – if you. Garage Door Installation and Replacement Cost ; Garage door parts cost ; Piece. Cost ; Door and tracks. $ to $1, ; Opener. $ to $ ; Labor. $ to $ If it's for a new garage, the installation can vary between $ for a single door and $ for a double door. If you are installing a new garage door opener. You should spend anywhere from $ to $6, on a new garage door. A number of factors affect how much a garage door replacement costs, such as door type. If you are looking for only installation services, the average cost will be around $ to $ Garage Door Type, Materials, Brand, and More. Garage doors are. The national average cost of a garage door replacement is $1,, according to HomeAdvisor, but the price you pay will likely vary depending on where you live. A single basic garage door cost can vary between $$ and a basic double garage door may be between $$ The cost of labor can be from $$ Steel doors are typically the most affordable, ranging from $ to $1, for a standard single-car door. Aluminum doors are more expensive, starting around. Average cost to install single-car garage doors is about $ (single-car garage door replacement). Find here detailed information about single-car garage. The average cost to install a new garage door is $1,, including a new opener. While garage door installation can typically range in price from about $1, The average price of a replacement garage door is typically $1, A garage door isn't simply an accessory: they offer several purposes such as increasing the. Single-panel garage doors tend to be cheaper than sectional designs, ranging from $ to $1, They are composed of one unit that slides up and into the. The cost to install a garage door varies depending on the type of door you select, as well as the size and materials. For a basic single-car garage door, you.

How To Start Day Trading Cryptocurrency

Can you make money day trading cryptocurrency? Yes, day trading is one of the best ways to make money with crypto. Trying to hold long-term can be risky because. First, pattern day traders must maintain minimum equity of $25, in their margin account on any day that the customer day trades. This required minimum equity. Day trading is very short-term trading, and it can mean holding an asset for just a few seconds, to a couple of hours. The idea is that you sell your asset. A day trading cryptocurrency strategy is a method of trading that aims to profit from the up-and-down price movements in the crypto market within a single. How to Report Cryptocurrency Day Trading and Short-Term Gains or Losses on Taxes Better to just report your activity accurately from the start. Are Crypto. Day trading in crypto is not as strict as day trading securities in regulations. However, it follows the same idea that orders opened on the same day are to be. These tools enable traders to identify potential entry and exit points based on technical analysis, market sentiment, and breaking news. Many day traders. Crypto-day trading is a strategy that represents buying and selling digital currencies, such as Bitcoin, Ethereum, Litecoin, and others. To make profits from cryptocurrency trading, ensure to have a good source(s) of income. The essence of this is to reduce your level of emotions. Can you make money day trading cryptocurrency? Yes, day trading is one of the best ways to make money with crypto. Trying to hold long-term can be risky because. First, pattern day traders must maintain minimum equity of $25, in their margin account on any day that the customer day trades. This required minimum equity. Day trading is very short-term trading, and it can mean holding an asset for just a few seconds, to a couple of hours. The idea is that you sell your asset. A day trading cryptocurrency strategy is a method of trading that aims to profit from the up-and-down price movements in the crypto market within a single. How to Report Cryptocurrency Day Trading and Short-Term Gains or Losses on Taxes Better to just report your activity accurately from the start. Are Crypto. Day trading in crypto is not as strict as day trading securities in regulations. However, it follows the same idea that orders opened on the same day are to be. These tools enable traders to identify potential entry and exit points based on technical analysis, market sentiment, and breaking news. Many day traders. Crypto-day trading is a strategy that represents buying and selling digital currencies, such as Bitcoin, Ethereum, Litecoin, and others. To make profits from cryptocurrency trading, ensure to have a good source(s) of income. The essence of this is to reduce your level of emotions.

As the name suggests, day trading refers to opening and closing a cryptocurrency trade on the same day. A trader intends to buy low and sell high on the same. Crypto-day trading can be lucrative, but it also has a high risk of losing money. Most day traders lose money, but successful people can make much money. To be. Crypto's inherent volatility is both its greatest strength and its biggest risk. For day traders, this volatility translates to opportunity. Cryptocurrencies are not subject to day trading rules. After enabling Cryptocurrency Trading, please restart the tastytrade platform to begin placing trades. The strategy of crypto day trading entails entering and exiting a position in the market on the same day within crypto trading hours. It's also known as. The best five crypto trading strategies are arbitrage, buy and hold, swing trade, day trading, and scalping. Learn all strategies in depth to make profits. 10 Best Crypto Exchanges for Day Trading () · Quick look: Best Exchanges for Day Trading · Binance · Kraken · ByBit · Coinbase Advanced · KuCoin · MexC · OKX. Security is paramount when selecting a day trading crypto exchange. Opt for platforms that implement advanced security protocols such as two-factor. gentleherd.ru Exchange Trading Pair Limit. The Daily Trading Limit is the maximum trading amount for a token across 24 hours. This limit applies to your Master. As an investment strategy, day trading crypto is an approach that relies on compounding small gains over a protracted period of time. This is. As the name suggests, day trading refers to opening and closing a cryptocurrency trade on the same day. A trader intends to buy low and sell high on the same. Volatility measures the price fluctuations of a cryptocurrency over time. For day traders, volatility is essential as it provides trading opportunities to. Have cryptocurrencies left you in a spin? Do you want to take advantage of their immense power but don't know where to start? Are you seeking the opportunity. You Gone to Learn my favorite Indicators for a Cryptocurrency Day Trading. · You Gone to Learn what it's the difference between Spot and Leverage in. To get started, follow these steps: Understand what crypto trading is; Learn why people trade cryptos; Pick a cryptocurrency to trade; Open a CFD trading. However, most experts recommend starting at least $$ This gives enough cushion to absorb losses as you learn without wiping out your. You open and close the same options contracts within a single trading day Crypto trading is offered through Robinhood Crypto, LLC. Robinhood Crypto is. Investopedia defines it as buying and selling a security in a single trading day. We do a lot of that around here! In other words, you're not holding a stock or. Crypto lets anyone become a trader. There's no need to register with a brokerage, pay expensive fees, qualify for trader status, or any of that with crypto.

Best Web Hosting For Seo

If you do not understand how changing your domain name and website host might affect your SEO, you are in good company. This is another question that is quite. Stable (always on) web hosting is key to success in search engines. If your hosting is unstable (your website goes down occasionally), neither users nor search. Best SEO web hosting for WordPress sites — for the overall best WordPress hosting for SEO, go with Kinsta or WP Engine, as they offer the best performance. SEO VPS hosting is an option for users who require more control over their websites environment than shared hosting or who need to provide their WordPress. WordPress endorsed DreamHost and is the best website hosting for seo. The company's shared hosting plan includes a drag-and-drop WordPress builder, + starter. Kinsta uses the Google Cloud Platform to host its websites, which offers fast and reliable hosting solutions. All websites hosted on Kinsta's. If you want the best website hosting for SEO, Namecheap is a great choice. They offer fast, reliable, and affordable hosting with excellent. Check out our ideas for brand-new SEO strategies! · Always use clean code: Even the best hosting solution cannot save your website from poorly written code that. HostPapa offers a service that guarantees superior website performance and % uptime. Plans include SEO tools and hands-on help with site optimization. If you do not understand how changing your domain name and website host might affect your SEO, you are in good company. This is another question that is quite. Stable (always on) web hosting is key to success in search engines. If your hosting is unstable (your website goes down occasionally), neither users nor search. Best SEO web hosting for WordPress sites — for the overall best WordPress hosting for SEO, go with Kinsta or WP Engine, as they offer the best performance. SEO VPS hosting is an option for users who require more control over their websites environment than shared hosting or who need to provide their WordPress. WordPress endorsed DreamHost and is the best website hosting for seo. The company's shared hosting plan includes a drag-and-drop WordPress builder, + starter. Kinsta uses the Google Cloud Platform to host its websites, which offers fast and reliable hosting solutions. All websites hosted on Kinsta's. If you want the best website hosting for SEO, Namecheap is a great choice. They offer fast, reliable, and affordable hosting with excellent. Check out our ideas for brand-new SEO strategies! · Always use clean code: Even the best hosting solution cannot save your website from poorly written code that. HostPapa offers a service that guarantees superior website performance and % uptime. Plans include SEO tools and hands-on help with site optimization.

The best SEO supermen are speedy servers, so keep that in mind. Plan on selecting providers that have the latest equipment, such as SSDS and caching mechanisms. We have vetted all the hosts that we've shown here, to make sure Yoast SEO runs without issue on their sites. We have explain why having a reliable hosting service is crucial for boosting website speed, security, uptime, technical support and ensuring server location. Change the DNS settings of your domain name to point to the new hosting infrastructure. This step is the actual site move step that starts the process of. Providers like Bluehost, SiteGround, and A2 Hosting are popular for their performance, uptime, and customer support, positively impacting SEO. While shared hosting may be a good option for those on a budget or with less demanding websites, VPS hosting is the better choice for those looking to take. Web hosting is a crucial factor for better SEO ranking and deliver a smooth user experience. When it comes to SEO, your web host can make a big difference. Check out our list of the best SEO web hosting companies. Buy 20X Faster SEO Panel Hosting. Blazing Fast Turbo Servers Make A2 Hosting The Best SEO Panel Web Hosting Provider. Search engine optimization (SEO) web hosting can give websites a boost in visibility and ranking. It makes it simpler for customers to find you. Why should I host my website with an SEO agency? · % Uptime guarantee · Instant page load times · Realtime malware detection · Optimized for SEO · Daily backups. Speed is a basic requirement for staying on top of SERP rankings. Our best SEO hosting ensures that your website loads quickly and thus get ranked higher in. Pressable's managed WordPress hosting is best suited for small business and ecommerce sites, HostArmada's shared hosting is more affordable for. Good web hosting can help website owners ensure a seamless user experience. Choosing the best web host has the potential to maximize conversions by offering. Why should I host my website with an SEO agency? · % Uptime guarantee · Instant page load times · Realtime malware detection · Optimized for SEO · Daily backups. #2 – Bluehost Review — The Best for New WordPress Websites. Screenshot of Bluehost's webpage featuring Neil Patel as an example of best website hosting services. Top Web Hosting Providers for SEO in · 1. Hostinger – Best Value for Money · 2. Kinsta – Premier Managed WordPress Hosting · 3. Cloud86 – The Best for. domain lookup. wordpress hosting. buy domain name. free domain name. best web hosting. vps hosting. Top Web Hosting Providers for SEO in · 1. Hostinger – Best Value for Money · 2. Kinsta – Premier Managed WordPress Hosting · 3. Cloud86 – The Best for. So, if you target some geo-specific audience, it makes sense to opt for a web host present in that location. Your website will also load faster for them. As.

Chime Checking Review

Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. The Chime Checking Account has no minimum balance fees or monthly service fees, so you don't need to dig into your wallet to open the account, nor pay to keep. No overdraft fees, no surprises and the app is amazing!! Big banks scam is but chime is not one of them. Conclusion. Chime is an excellent financial app choice for individuals who want to enjoy excellent mobile capabilities and streamlined financial services with. “I choose Chime because it's a no-brainer! Chime has helped me raise my credit score & has helped me get better at budgeting.”. It is reliable and simple to use. The Sign-up process of Chime Online Banking was simple and I was able to easily set up a direct deposit and link my bank. The fintech company's online banking service offers a checking account that delivers your paycheck up to two days early. Also, its savings account offers a. To check your Chime Checking Account balance you can go online, through the mobile app, or at an ATM. To log in your online banking account or mobile app, you. Chime Reviews. 9, • Poor. VERIFIED COMPANY. In the Financial Institution Chime is a financial technology company, not a bank. Banking services. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. The Chime Checking Account has no minimum balance fees or monthly service fees, so you don't need to dig into your wallet to open the account, nor pay to keep. No overdraft fees, no surprises and the app is amazing!! Big banks scam is but chime is not one of them. Conclusion. Chime is an excellent financial app choice for individuals who want to enjoy excellent mobile capabilities and streamlined financial services with. “I choose Chime because it's a no-brainer! Chime has helped me raise my credit score & has helped me get better at budgeting.”. It is reliable and simple to use. The Sign-up process of Chime Online Banking was simple and I was able to easily set up a direct deposit and link my bank. The fintech company's online banking service offers a checking account that delivers your paycheck up to two days early. Also, its savings account offers a. To check your Chime Checking Account balance you can go online, through the mobile app, or at an ATM. To log in your online banking account or mobile app, you. Chime Reviews. 9, • Poor. VERIFIED COMPANY. In the Financial Institution Chime is a financial technology company, not a bank. Banking services.

Chime is best for anyone regardless of financial capability or financial past. Chime does not do credit checks as part of the signup process. For those who've. Chime is just what you would expect out of a bank. You can open a checking and savings account just as you would with any other banking service. One of the main. Except for Chime's card, Cheese debit card is an excellent card as well, helping you save money easily. Cheese offers a cash bonus and no banking fee. Sounds. A free online spend account with modern banking perks like early direct deposit and unique overdraft services. The checking and savings accounts have no monthly service fees and no minimum balance requirements. The checking account charges no overdraft fees and provides. Chime is an easy-to-use and safe online banking platform that offers basic deposit accounts as well as benefits such as automated savings tools. A review of complaints was done in June For information concerning account security and account log in issues, consumers should review the following. Chime leverages financial technology to offer innovative banking products and services through a mobile app. When you sign up for a typical checking account, there are fees. Monthly service fees, minimum balance requirements, overdraft fees, foreign transaction fees. * Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC. The Chime Visa® Debit. Chime is a top choice for customers who want simple banking options with few fees and an excellent mobile app for banking on the go. Although Chime has no. Chime has liberated me from living check to check by including a savings account I'll never go back to any other financial institutions, thanks Chime! · [Chime. Chime's customer service is responsive, and the company has branded itself well as an alternative to traditional banks. Chime® Checking Account is STRONGLY RECOMMENDED based on reviews. Find out why before you make a decision. Chime also has expanded SpotMe to its Credit Builder Visa Credit Card5. This means members can now use their Credit Builder card to access up to $ in fee-. Chime has liberated me from living check to check by including a savings account I'll never go back to any other financial institutions, thanks Chime! · [Chime. At Chime, we profit with our members, not off of them. Banking shouldn't cost you – our online checking account has no maintenance fees and includes helpful. Chime has star rating based on customer reviews. Consumers are mostly dissatisfied. · 26% of users would likely recommend Chime to a friend or colleague. Chime leverages financial technology to offer innovative banking products and services through a mobile app. I love the app overall, it's a great way to manage your checking & savings while also building your credit, it's a great & affordable way to control & oversee.

The Best First Credit Card

Comparison of the easiest credit cards ; First Progress Platinum Prestige Mastercard® Secured Credit Card, Low interest, Poor, limited or no credit, $, $ Credit cards come with a credit limit, which is the maximum amount the card company will lend you on the card. If you spend too much and go over your credit. Citi® Secured Mastercard® · Discover it® Secured Credit Card · Capital One QuicksilverOne Cash Rewards Credit Card. Earn rewards, enjoy competitive rates, or build your credit with a Visa credit card from Community First Credit Union Our traditional card is best for. Chase Freedom Unlimited card · 5% cashback on groceries up to $12, in the first year · 5% cashback on travel · 3% cashback on drugstore purchases · 3% back on. Secured credit cards may be an opportunity to establish credit and can give you practice for your first standard credit card. They also give those with less. The best starter credit card is the Capital One Platinum Credit Card (see Rates & Fees) because it has a low $0 annual fee and accepts applicants with limited. When you first open the Petal 2 Visa Credit Card, you get 1% cash back on eligible purchases right away. Your cash back then increases up to % after making. Know how to choose the right first credit card for you with guidance on the best ways to start building your credit history. Comparison of the easiest credit cards ; First Progress Platinum Prestige Mastercard® Secured Credit Card, Low interest, Poor, limited or no credit, $, $ Credit cards come with a credit limit, which is the maximum amount the card company will lend you on the card. If you spend too much and go over your credit. Citi® Secured Mastercard® · Discover it® Secured Credit Card · Capital One QuicksilverOne Cash Rewards Credit Card. Earn rewards, enjoy competitive rates, or build your credit with a Visa credit card from Community First Credit Union Our traditional card is best for. Chase Freedom Unlimited card · 5% cashback on groceries up to $12, in the first year · 5% cashback on travel · 3% cashback on drugstore purchases · 3% back on. Secured credit cards may be an opportunity to establish credit and can give you practice for your first standard credit card. They also give those with less. The best starter credit card is the Capital One Platinum Credit Card (see Rates & Fees) because it has a low $0 annual fee and accepts applicants with limited. When you first open the Petal 2 Visa Credit Card, you get 1% cash back on eligible purchases right away. Your cash back then increases up to % after making. Know how to choose the right first credit card for you with guidance on the best ways to start building your credit history.

Top Credit Card Links Top Credit Card Links. Credit Card Home · Application Center · Check for Customized Offers · Manage Your Credit Card Account · View All. Best Starter Credit Cards for Students · Chase Freedom® Student credit Card - Good for earning cash back and getting an automatic credit limit increase. Applying for a beginner card, like a secured credit card or student credit card, might be a good way to start your credit journey. See if you're pre-approved. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. Chase offers one called the Freedom Rise credit card. If approved for this card, you could earn % cash back on every purchase. In addition, cardmembers can. Recommended Credit Score: – · Annual Fee: $95 · Bonus Offer: , bonus points for spending $8, in the first 3 months. Another type of card that may interest you is cash rewards credit card, which earns you cash rewards when using the card to make purchases. Own your own. The first step in determining the best credit card to apply for is to figure out where you stand credit-wise. There are credit cards available for people who. These accounts are typically for people between the ages of 18 and 21 years old. They offer a lower credit limit to teach your child the importance of paying. Earn 1% Cash Back Rewards with First Progress Prestige! · Apply now and fund your security deposit over 90 days with the option to make partial payments. · You. Best credit cards of September · + Show Summary · Capital One SavorOne Cash Rewards Credit Card · Chase Sapphire Preferred® Card · Wells Fargo. Start by focusing on the cards available for someone with your credit score, and then start comparing everything about those cards. Applying for a beginner card, like a secured credit card or student credit card, might be a good way to start your credit journey. See if you're pre-approved. Credit cards come with a credit limit, which is the maximum amount the card company will lend you on the card. If you spend too much and go over your credit. The Citi Rewards+℠ Student Card is best for making small purchases and supermarket shopping, while the Deserve® EDU Mastercard for Students is best for. Best Starter Credit Cards for Students · Chase Freedom® Student credit Card - Good for earning cash back and getting an automatic credit limit increase. Chase Freedom Unlimited card · 5% cashback on groceries up to $12, in the first year · 5% cashback on travel · 3% cashback on drugstore purchases · 3% back on. As you will be applying for an Amex US credit card, you will need to have some history with Amex in Canada. There are two methods to apply for your first card. Applying for your first credit card isn't always cut-and-dry, as you usually need an income and some credit to be approved for certain cards. Below are a few terms to familiarize yourself with, and possibly look for, before you submit the application for your first credit card. Interest rate: You will.

Detroit Reits

REIT investing involves real estate investment trusts. REITs own and/or manage income-producing commercial real estate. REITs: For stockholders in a Real Estate Investment Trust (REIT), they Commercial Real Estate, Detroit, Detroit Real Estate, Iconic, Iconic Detroit. Top 25 real estate investment trust companies in Michigan · 1. AGM Management LLC · 2. R.E. Schell Enterprises, LLC · 3. McKinley Companies, LLC · 4. Eenhoorn LLC. Detroit Development · Key UK Real Estate Concerns: Alarm bells sound clear warning to landlords over consequences of. Client Alert Key UK Real Estate Concerns. MGM Grand. Detroit, Michigan. VICI Properties Inc. MGM Grand. Detroit, Michigan. VICI Properties Inc. Omega Pipeline., Michigan. CorEnergy Infrastructure Trust. Detroit, for example. 5. Mortgage REITs. Mortgages make up about 10% of REIT assets rather than actual real estate. Fannie Mae and Freddie Mac are the two. US Investor Group provides real estate investors from around the world with exclusive property investments in the Metro Detroit market. We examine the entire. Coughlin Capital has grown out of over 60 years of family owned and operated businesses originally located in Detroit, Michigan. In Coughlin Capital. Real Estate Investment Trusts. Manta has 22 businesses under Real Estate Investment Trusts in Detroit, MI. Featured Company Listings. Provisions Holdings. REIT investing involves real estate investment trusts. REITs own and/or manage income-producing commercial real estate. REITs: For stockholders in a Real Estate Investment Trust (REIT), they Commercial Real Estate, Detroit, Detroit Real Estate, Iconic, Iconic Detroit. Top 25 real estate investment trust companies in Michigan · 1. AGM Management LLC · 2. R.E. Schell Enterprises, LLC · 3. McKinley Companies, LLC · 4. Eenhoorn LLC. Detroit Development · Key UK Real Estate Concerns: Alarm bells sound clear warning to landlords over consequences of. Client Alert Key UK Real Estate Concerns. MGM Grand. Detroit, Michigan. VICI Properties Inc. MGM Grand. Detroit, Michigan. VICI Properties Inc. Omega Pipeline., Michigan. CorEnergy Infrastructure Trust. Detroit, for example. 5. Mortgage REITs. Mortgages make up about 10% of REIT assets rather than actual real estate. Fannie Mae and Freddie Mac are the two. US Investor Group provides real estate investors from around the world with exclusive property investments in the Metro Detroit market. We examine the entire. Coughlin Capital has grown out of over 60 years of family owned and operated businesses originally located in Detroit, Michigan. In Coughlin Capital. Real Estate Investment Trusts. Manta has 22 businesses under Real Estate Investment Trusts in Detroit, MI. Featured Company Listings. Provisions Holdings.

Both exchange traded REITS and non-traded REITs investment in real estate Detroit, Honolulu, Houston, Los Angeles, Miami, New York City, Philadelphia. Find a REIT focused on Detroit. Invest passively in a company with audited financials. Sell as much as you want, whenever you want, painlessly. Real estate investing in Detroit, MI · gentleherd.ru Real Estate Specialists · gentleherd.ru LOFTS · gentleherd.ru Flow Detroit LLC · gentleherd.ru City Hot Deals. Browse 34 DETROIT, MI REAL ESTATE APPRAISER TRAINEE jobs from companies (hiring now) with openings. Find job opportunities near you and apply! Your premier Detroit real estate investment partner offering Detroit turnkey properties, property management, and portfolio investment opportunities. Anyone know of any REITs that have Detroit exposure? With the ridiculous real estate prices in Detroit right now I feel like it may be a good time to invest in. Whether you are buying or selling, our Detroit-based team of professionals are experts in all areas of commercial real estate transactions for land and. REIT's success. Those attributes position Agree Realty for future growth, as it continues to focus on the mission-critical physical stores of some of the. Alex Meskouris of Detroit discusses that investing in funds and trusts, you can profit from real estate investments without purchasing an entire property. Hybrid REITs combine investment strategies from equity REITs and mortgage REITs and invest in property and mortgages. Detroit, Honolulu, Houston, Los Angeles. Today's top 9 Reit jobs in Detroit, Michigan, United States. Leverage your professional network, and get hired. New Reit jobs added daily. Crestlight Capital is a commercial real estate operating platform that Detroit: Woodward Ave, Floor 5, Detroit, MI New York: Madison. Real Estate Investment Trusts (REITs). Well-Capitalized REITs Recognize DETROIT, MICHIGAN HOUSTON, TEXAS DALLAS, TEXAS MIAMI, FLORIDA NEW YORK, NEW. Alex Meskouris explains that a real estate investment trust, also known as an REIT, is a company that owns, operates, or finances income-producing real estate. Allied Properties REIT is a leading owner and developer of urban office space that enhances profitability for business tenants operating in Canada. Real Estate Investment Trusts (REITs). Practice Contacts. Richard E. Aderman · Chicago · Dave J. Bartoletti · Indianapolis · William E. Sider · Detroit . Detroit Buy Hold Invest, Detroit, Michigan. likes · 1 talking about this. Specializing in a Real Estate selling over properties per year to. Estate Partners and Detroit-based real estate investment firm Larson Realty Group. Larson also represented funds managed by Lazard Alternative Investments. Marcel Pearl is a Commercial Retail Estate Broker in the City of Detroit with over 15 years of sale experience. He focuses on the acquisition and. An actively managed equity Portfolio that seeks compelling outperformance by investing in REITs and real estate related businesses.

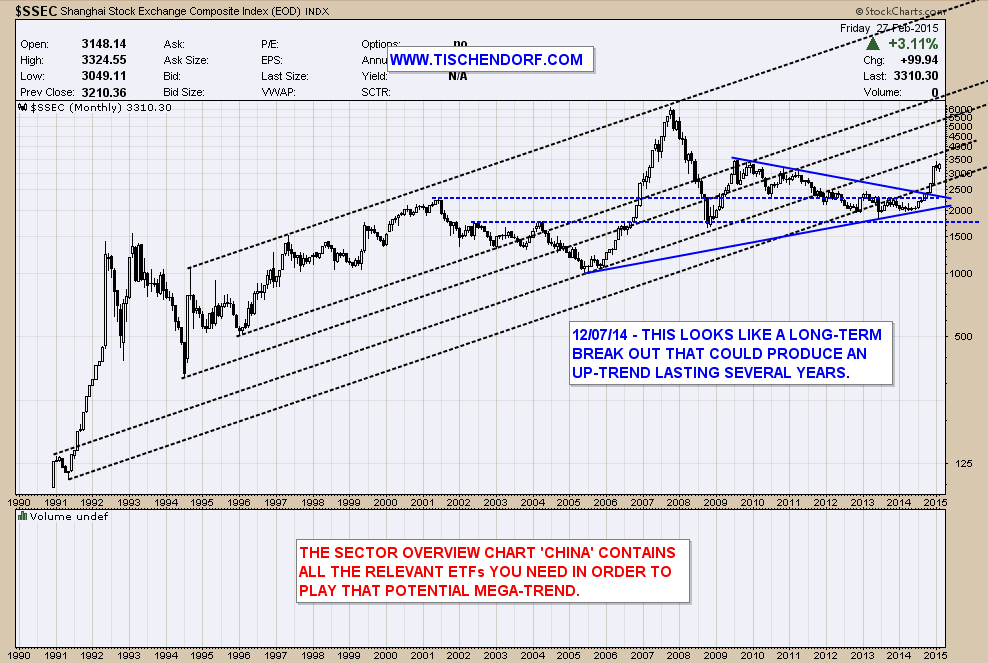

Shanghai Stock Exchange Etf

The easiest way to invest in the whole Chinese stock market is to invest in a broad market index. This can be done at low cost by using ETFs. The Hang Seng China A Industry Top Index is a freefloat-adjusted market capitalisation weighted index. The Index reflects the performance of industry leaders. ETF via Shanghai-Hong Kong Stock Connect ; , E Fund CSI SEEE Carbon Neutral ETF. E Fund Management Co., Ltd. ; , E Fund MSCI China A 50 Connect ETF. E. The iShares Core CSI Index ETF seeks to track the performance of an index composed of large and mid-capitalization stocks traded on the Shanghai and. SSE 50 Exchange Traded Open-End Index Securities Investment Fund (50 ETF) · Call options and put options · 10, · Current month, next month and the following two. The iShares MSCI China ETF seeks to track the investment results of an index composed of Chinese equities that are available to international investors. Why XCH? 1. Exposure to equities of 50 of the largest Chinese companies, by market cap, in a single fund 2. Can be used to express a single country view. The Shanghai Stock Exchange Composite Index is a capitalization-weighted index. The index tracks the daily price performance of all A-shares and B-shares. China equities ETFs are funds that invest in China-based corporations. The funds in this category include index funds as well as category specific funds. The easiest way to invest in the whole Chinese stock market is to invest in a broad market index. This can be done at low cost by using ETFs. The Hang Seng China A Industry Top Index is a freefloat-adjusted market capitalisation weighted index. The Index reflects the performance of industry leaders. ETF via Shanghai-Hong Kong Stock Connect ; , E Fund CSI SEEE Carbon Neutral ETF. E Fund Management Co., Ltd. ; , E Fund MSCI China A 50 Connect ETF. E. The iShares Core CSI Index ETF seeks to track the performance of an index composed of large and mid-capitalization stocks traded on the Shanghai and. SSE 50 Exchange Traded Open-End Index Securities Investment Fund (50 ETF) · Call options and put options · 10, · Current month, next month and the following two. The iShares MSCI China ETF seeks to track the investment results of an index composed of Chinese equities that are available to international investors. Why XCH? 1. Exposure to equities of 50 of the largest Chinese companies, by market cap, in a single fund 2. Can be used to express a single country view. The Shanghai Stock Exchange Composite Index is a capitalization-weighted index. The index tracks the daily price performance of all A-shares and B-shares. China equities ETFs are funds that invest in China-based corporations. The funds in this category include index funds as well as category specific funds.

The China-Japan ETF Connectivity is a scheme for creating ETFs that link the ETF markets of Shanghai Stock Exchange and Tokyo Stock Exchange. Based on QDII. The term China ETF refers to an exchange-traded fund (ETF) that invests in Chinese securities. Like other ETFs, shares are listed and traded on stock exchanges. Shanghai Stock Exchange (SSE) was established in · SSE operates 2 boards – mainboard and STAR Market – which provide products of stocks, bonds, funds. Will all SSE-listed and SZSE-listed ETFs be eligible for trading through. Shanghai Connect and Shenzhen Connect? Hong Kong and overseas investors will be able. The iShares MSCI China A ETF seeks to track the investment results of an index composed of domestic Chinese equities that trade on the Shanghai or Shenzhen. SSEC is the ticker symbol of the Shanghai Composite index. Is Shanghai Composite a Good Stock Market Index to Invest In? Shanghai Composite offers exposure to a. SSE 50 ETF is the first ETF launched in China. Since its inception, SSE 50 ETF is always one of the largest ETF in China with excellent liquidity. CXSE · WisdomTree China ex-State-Owned Enterprises Fund, Equity ; CNYA · iShares MSCI China A ETF, Equity ; CWEB · Direxion Daily CSI China Internet Index Bull 2x. The iShares Core CSI Index ETF seeks to track the performance of an index composed of large and mid-capitalization stocks traded on the Shanghai and. On April 22, , Shanghai Stock Exchange (SSE) and Japan Exchange Group (JPX) agreed to establish China-Japan ETF Connectivity. In July , ETFs are included into the investment targets of the trading connectivity between the stock markets of Mainland and Hong Kong. Get Shanghai .SSEC:Shanghai Stock Exchange) real-time stock quotes, news, price and financial information from CNBC. Performance charts for Guotai Shanghai Stock Exchange Financial Index ETF ( - Type ETF) including intraday, historical and comparison charts. The CSI Index is composed of the large- and mid-cap China A-Share stocks listed on the Shenzhen or Shanghai Stock Exchange. Morningstar ratings. As. The vanguard among ETFs honing in on the Shanghai Stock Exchange is the FXI - iShares China Large-Cap ETF. Its mission is to echo the rhythms of the Chinese. What is the SSE index? The Shanghai Stock Exchange Index (SSE) or Shanghai Composite index as it's sometimes known, is the major, broad based benchmark, for. Differences in trading hours between STAR Board of the SSE and the SEHK may also increase the level of premium or discount of the Share price to its NAV. While. SHCOMP | A complete Shanghai Composite Index index overview by MarketWatch. View stock market news, stock market data and trading information. What is the SSE index? The Shanghai Stock Exchange Index (SSE) or Shanghai Composite index as it's sometimes known, is the major, broad based benchmark, for.

Best Debit Card For A Teenager

1. Greenlight Debit Card. Age requirements: None. Monthly fee: $$ Free trial: One month. If you're under 18, our Teen MyCash Current Account is a great place for your pocket money You can put your favorite selfie on a personalized bank card! No Monthly Service Fee · Designed for kids ages , available for ages · Banking account owned and managed by you · Exclusively for Chase checking customers. A debit card is like "training wheels" to get your teen familiar with using plastic for purchases. It familiarizes them with how to track their bank account. best way to educate teens about banking and money management. Giving your child access to a checking account and debit card can give them hands-on. Open up a teen checking account with a contactless debit card, get no minimums and ATM rebates up to $20/month. Apply today. A teen checking account with zero fees and a fee-free debit card for kids. Help your teen take the first step towards managing their own money with a bank. You can set up a separate share draft account (checking account) in your child's name, with a debit card issued in their name as well. This is the best way for. Greenlight's debit card for kids empowers parents to teach trade-off decisions, money management, and the power of saving and investing – in one app. 1. Greenlight Debit Card. Age requirements: None. Monthly fee: $$ Free trial: One month. If you're under 18, our Teen MyCash Current Account is a great place for your pocket money You can put your favorite selfie on a personalized bank card! No Monthly Service Fee · Designed for kids ages , available for ages · Banking account owned and managed by you · Exclusively for Chase checking customers. A debit card is like "training wheels" to get your teen familiar with using plastic for purchases. It familiarizes them with how to track their bank account. best way to educate teens about banking and money management. Giving your child access to a checking account and debit card can give them hands-on. Open up a teen checking account with a contactless debit card, get no minimums and ATM rebates up to $20/month. Apply today. A teen checking account with zero fees and a fee-free debit card for kids. Help your teen take the first step towards managing their own money with a bank. You can set up a separate share draft account (checking account) in your child's name, with a debit card issued in their name as well. This is the best way for. Greenlight's debit card for kids empowers parents to teach trade-off decisions, money management, and the power of saving and investing – in one app.

Best Overall: Axos Bank First Checking This account earns our top spot for the best checking account for teens because it rarely charges fees, reimburses ATM. Below is a list of 10 best Debit cards for teens · Greenlight Debit Card. The Greenlight Debit Card is one of the best debit cards for teens. · GoHenry · The. Axos Bank First Checking · Alliant Credit Union Teen Checking · USAA Youth Spending Account · Connexus Credit Union Teen Checking · Georgia's Own Credit Union Youth. SafeBalance Banking® is a smart choice for students and young adults with no monthly maintenance fee for SafeBalance Banking® accounts with an owner under. Best Debit Cards for Kids and Teens in August Greenlight, BusyKid and More · Best overall. Greenlight Debit Card for Kids · Best for financial literacy. Best Prepaid Debit Cards for Teens—Three Options Reviewed · Greenlight · GoHenry Prepaid Card for Teens · FamZoo. Free Debit Card; Free Personal Savings Account; Not available: Bill Pay, check writing privileges and overdraft protection. More ways to bank with us. Debit. For teens age 13 - 16, look no further than the Clear Access Banking account. Great for middle and high school students and parents who want a joint account. You'll love the TD Go Card because: Your teen can add the card to digital wallets for more ways to pay. You can use the card to set a budget for your teen's. PLANS FOR EVERY FAMILY. Greenlight Core: Debit card and educational app for kids and teens to earn, save, spend, and give — plus 2% on savings² ($/month. Best for Younger Children: GoHenry. In essence, GoHenry is a prepaid card for parents to deposit their child's allowance. But it's much more than that. Just ask. The Best Debit Cards For Kids · Greenlight Prepaid Debit Card · FamZoo Prepaid Debit Card · Capital One MONEY Card · gohenry Debit Card · BusyKid Prepaid. Oversee your teen's finances easily with Venmo's debit cards. Split bills, share payments, and more. Sign up on gentleherd.ru today. Why choose a GoHenry teen debit card? · The GoHenry teen debit card gives you the independence you need. Pay, get paid, save, budget, shop, and learn the skills. A debit card can limit your teen's ability to overspend. If you want to teach your child responsible spending habits, a debit card might be a great tool. Credit. A teen debit card can be part of your child's overall money education and a way to raise financially confident teens. It can also help inspire a larger. Open a bank account for your child today Help your child build good money habits while you keep an eye on their spending. Greenlight is a straightforward and easy-to-use kids debit card and app. Unlike other kids debit card apps, Greenlight downplays payment for chores and instead. Despite its name, the Capital One MONEY Teen Checking is not just for teens. Kids ages 8 and older can sign up (with a parent or guardian) and get a debit card. In order to encourage good financial education at an early age, parents are encouraged to introduce debit card usage to kids. We cover free.